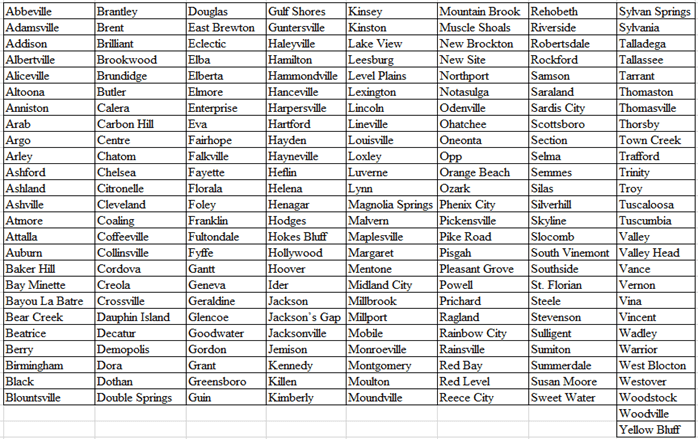

On July 12, 2023, the Examiners of Public Accounts provided notice that the below municipalities submitted annual reports of license revenues or other taxes and fees collected in their police jurisdiction in accordance with Act 2021-297. These municipalities may continue to impose municipal licenses, taxes, and fees in their police jurisdictions.

The prohibition against the collection of municipal licenses, taxes, and fees is limited to municipalities that failed to comply with the reporting provisions of Act 2021-297. This prohibition does not impact licenses, taxes, and fees within a municipality’s city limits nor state or county licenses, taxes, and fees. The local taxes within a municipality’s corporate limits and all state and county taxes must be collected and remitted. Other notices relating to this act may be accessed at https://www.revenue.alabama.gov/notice-act-2021-297-removal-of-certain-police-jurisdiction-license-taxes-and-fees/. For additional information see Act 2021-297.

If you have questions about this notice, contact:

Alabama Department of Revenue

P.O. Box 327790

Montgomery, AL 36132-7790

334-242-1490